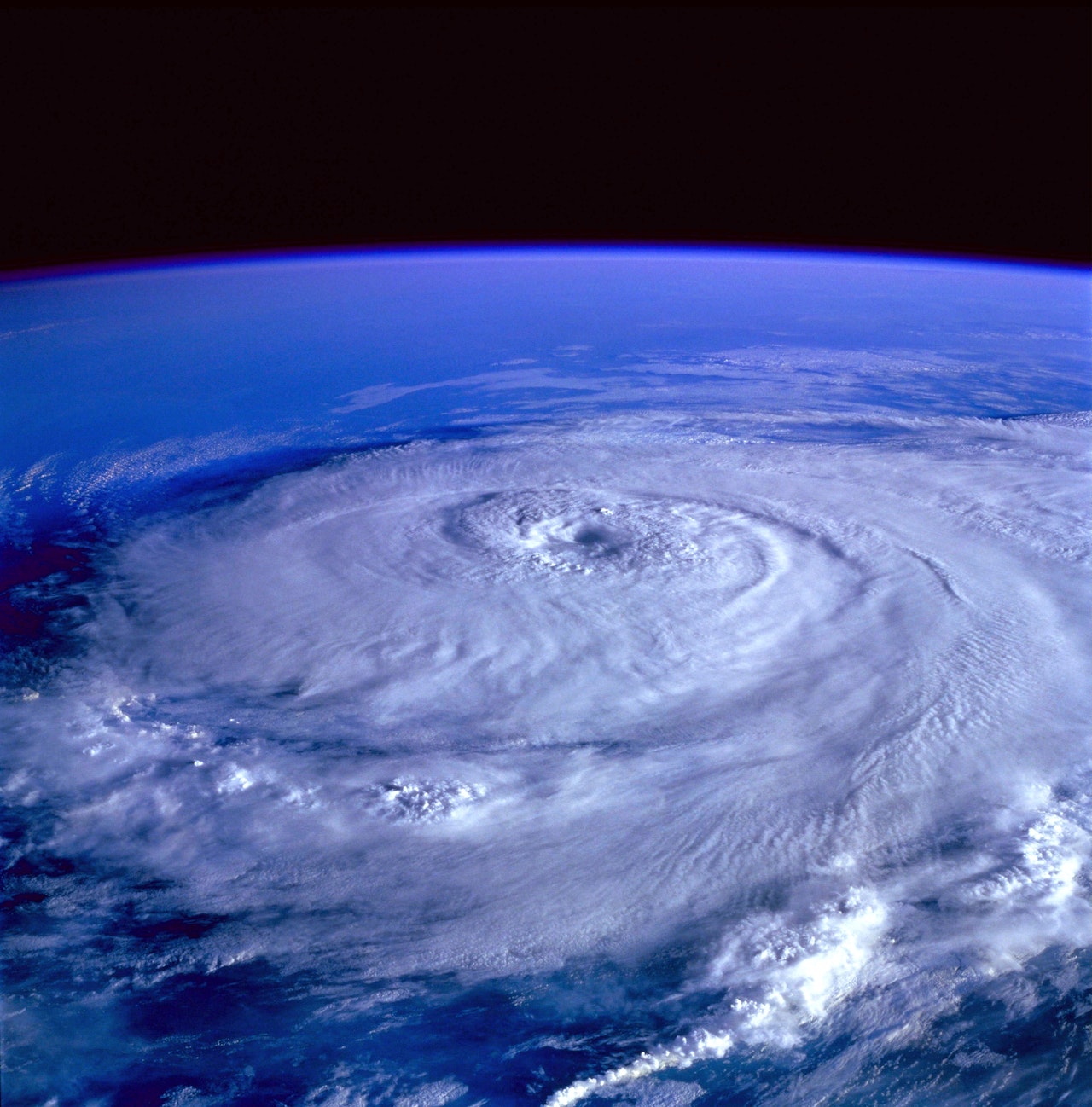

Hurricane Ian happened weeks ago, but the destruction of its path still remains evident. Those affected by the hurricane are receiving extra support from the IRS.

The IRS announced an extended deadline for hurricane victims. Those affected by Hurricane Ian that began on September 23 now have until February 15, 2023, to file various individual and business tax returns and make tax payments.

The Federal Emergency Management Agency declared a disaster and along with that the IRS announced that affected taxpayers in certain areas will receive tax relief.

This means that those affected and who have valid extension to file their 2021 return due to run out on October 17th, 2022, will now have until February 15, 2023, to file their return. The IRS wants to stress that if you did not file your return that was due on April 18, 2022, and did NOT have an extension on file, you will not be granted the extension for February 15, 2023. Your taxes will still be late.

To know if you qualify for the emergency tax relief, you can check the IRS website here for more location-based information.

Casualty Losses

Affected taxpayers in a federally declared disaster area have the option of claiming disaster-related casualty losses on their federal income tax return for either the year in which the event occurred, or the prior year. You can view the Publication 547 on the IRS website for more details about this tax claim.

If you had personal property losses, you can also declare that on your taxes if it was not covered by insurance or other reimbursements. For more details regarding this tax exemption, view these forms on the IRS website: Form 4684, Casualties and Thefts.PDF and its instructions.PDF

If you are an affected taxpayer and plan on claiming the disaster loss on your return, make sure to put the Disaster Designation, “FL Hurricane Ian” in bold letters at the top of the form. You also need to include the FEMA disaster declaration number, DR-4673-FL, on any return. View Publication 547 for more details regarding this.

If you have more questions about how to handle your taxes regarding this, OR any other tax questions, Tax Network USA is here to help. We will answer all of your tax related questions and even help you file your taxes, among many other services.

You can call us at 1(855) 225-1040 or fill out our contact form and we will contact you back ASAP!

Do you need help filing for Hurricane Ian tax relief?

or fill out our contact form and we will call you ASAP!